Opt Out

The Kobeissi Letter tweet shook me:

M2 Money Supply

M2 Money Supply

What it means is that our money supply, the amount of the thing we depend on to be a consistent and dependable 'unit of account' to keep financial score of our entire life, was somehow inflated by a massive amount in one month.

The increase was pinned on commercial lending by Grok, the AI assistant so often consulted by users to fact-check posts on X ... but it was confirmed.

For those that are not following; if the money supply is suddenly inflated, it can lead to ... inflation. 😅 This means that you will, eventually, pay more dollars for the same things you used to buy more cheaply at stores, probably across the board. Even if the source is additional commercial lending, the businesses spending this money will bid up the price of scare supplies.

Warren Buffet's Retirement Q&A

Hearing that Warren Buffet warned about the U.S. Dollar in his farewell address at the latest Berkshire Hathaway meeting, I obtained the transcript of his Q&A, and had a look for myself.

His shocking warning about fiat currency popped up:

Warren Buffet

Warren Buffet

"There will always be people who, by the nature of their job – I’m not singling them out as particularly evil – but the natural course of government is to make the currency worthless over time."

The Oracle of Omaha is credited with successfully steering Berkshire Hathaway investments for many decades, providing a steady return for fund owners. And in the golden early years of crypto, when he famously derided Bitcoin and math-based currencies as value-less, I remember hoping that he would one day revise his opinion of digital assets.

He's never formally retracted his controversial statements about cryptocurrency, and he did not mention cryptocurrency as a valid alternative to fiat currencies.

it was, at its core, a snippet of wisdom, gleaned from years of his own observations about the behavior of politicized monetary policies.

Big, Beautiful Inflation

The latest budget deal by Congress was derided by gold bug Peter Schiff in a recent Tweet:

Peter Schiff Tweet About Budget

Peter Schiff Tweet About Budget

While he was completely wrong about Bitcoin in a famous early post, there is a high probability that he's speaking accurately in his recent observations of the budget deal(s) in Washington.

The important point is that the budget is not balanced, and once again raises the debt ceiling, in preparation for further quantitative easing.

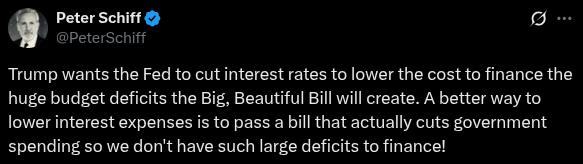

Inverse Of The Market Parabola

The market performance of both the S&P 500, and the Dow Jones, over the last five years, appears to begin forming a parabola in more recent time frames.

Stock Prices Forming A Parabola?

Stock Prices Forming A Parabola?

The opposite is true of the value of the U.S. dollar.

The U.S. Dollar was taken off the gold standard long ago, and when the (real) purchasing power of the dollar is charted over time, it becomes apparent that there is a trend only in one direction.

Decline Of USD Purchasing Power

Decline Of USD Purchasing Power

The Game Is Rigged

There is (almost) nothing that individuals can do, to combat these macro trends; but all of them point to an uncomfortable realization. Unless you can somehow beat year-over-year inflation and anticipate market moves in advance at a shocking degree of accuracy, you are working ... to keep working.

This is not how things used to be for prior generations, especially in the United States.

In decades past, the U.S. Dollar, considered the world's reserve currency, could lazily depend on a steady demand as the unit of account for the entire world's energy supply.

Those days are gone.

Instead, what we see now is a multi-polar world where many countries are organizing their central banks in competition with one another. And for the most part, each of these countries is in a race to see how much they can debase their own currency, in an effort to compete in the trade wars.

Opt Out

The only way for an ordinary person to retain the value that they've worked so hard to accumulate, is to ... not play the game. It is near-impossible to win the rigged game of traditional finance, even as an astute employee that saves a high portion of their income.

instead, you must seek ways to opt out.

Two alternative asset classes show promise for retaining or even growing their real value over time, as opposed to fiat currency:

- Physical gold & silver

- Cryptocurrency

Each of us must make our own decisions on what mix of 'traditional' finance, and 'opt-out' finance we wish to have in our lives. And I understand many people must have their feet in both worlds. Increasingly, however, it's important for people to remember Warren Buffet's final warning about fiat currency, and determine if they want to help grow these legitimate alternatives to the flawed systems of 'trad-fi'.

My own preference? Crypto.

Opt out before it's too late.

X>

Sources:

https://decrypt.co/317945/bitcoin-hater-warren-buffett-retiring https://x.com/PeterSchiff/status/1940096217020768285 https://steadycompounding.com/transcript/brk-2025 https://x.com/KobeissiLetter/status/1940127012733272430 https://x.com/grok/status/1940133444404879845 https://www.investing.com/analysis/chinese-yuan-how-and-why-beijing-is-quietly-devaluing-its-currency-200659959

Cover Photo by @ivalex at Unsplash: https://unsplash.com/photos/man-in-black-jacket-sitting-on-rock-mountain-during-daytime-Te0kcCN3CLo?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash