Xahau: By The Numbers

As Xahau approaches the close of the second (calendar) year of operations, the network metrics paint a picture of how the ecosystem has been used by its early adopters and champions.

XAH Badger Reviews The Xahau Ledger

XAH Badger Reviews The Xahau Ledger

From transaction volume and hook execution to decentralized exchange activity and account growth, the data, through approximately December 20, 2025, offers a grounded, quantitative snapshot of behavior.

What follows is a summarized walkthrough of Xahau’s year — told primarily through numbers.

For those that wish to read this content in its original form from @Silkjaer, refer here: Original Post on X.

High Level View

Over the last year, Xahau closed approximately 8 million ledgers and processed 615 million total transactions, with 608 million of those successfully validated. One of the most notable metrics is hook usage: 251 million hooks were executed, meaning that over 40% of all successful transactions triggered ("invoked") a hook.

This highlights that hooks are not a niche feature on Xahau, but a core part of how the network is used.

Transaction Breakdown

Looking more closely at transaction types, payments dominate the network with roughly 275 million transactions. Beyond simple transfers, Xahau shows heavy usage of programmable and token-related operations, with 52–62 million transactions each across categories such as:

- URITokenMint

- URITokenBuy

- URITokenBurn

- CreateSellOffer

- Invoke

- AccountSet

In contrast, governance participation via rewards remains comparatively limited: only 53,119 ClaimReward transactions were recorded across roughly 196,000 accounts. Over the year, 23.9 million XAH was minted, while 2.8 million XAH was burned, providing a view into net supply changes.

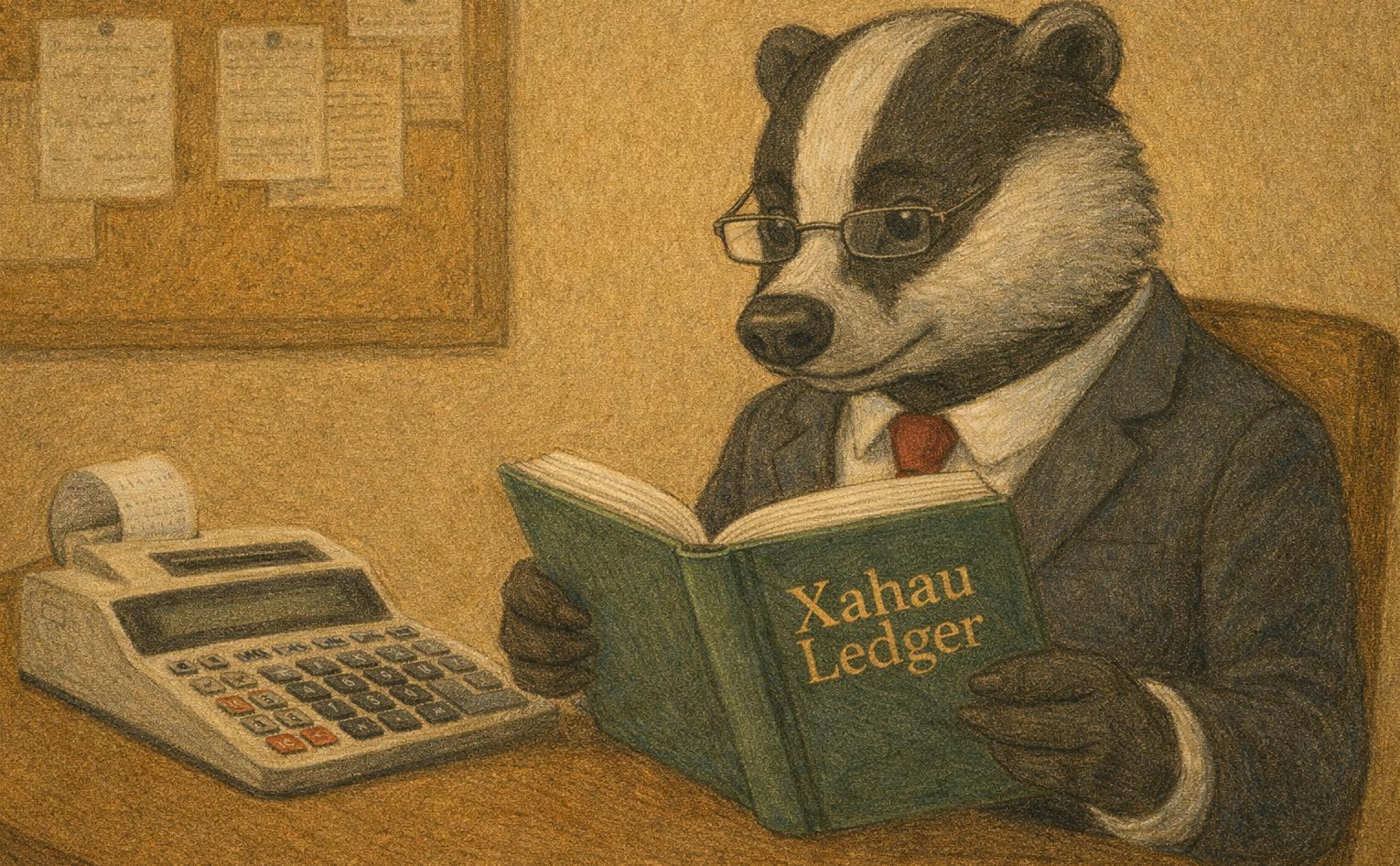

XAH Transfers

In terms of native token value, 238 million XAH changed hands across 268 million payment transactions, indicating that most transfers were relatively small in size rather than large, infrequent movements.

Native Token (XAH) Changing Hands

Native Token (XAH) Changing Hands

Escrow usage exists but remains modest by comparison, with 140 escrow releases accounting for 12.9 million XAH. While escrow functionality is present and used, the dominant pattern on Xahau is still direct, immediate settlement.

Account Creation

Network growth is reflected in account creation, with approximately 89,900 new accounts created over the year. A snapshot a few days later confirms this approximate number:

Account Creation

Account Creation

This steady pace aligns with Xahau’s focus on infrastructure, programmability, and utility-driven adoption rather than speculation alone.

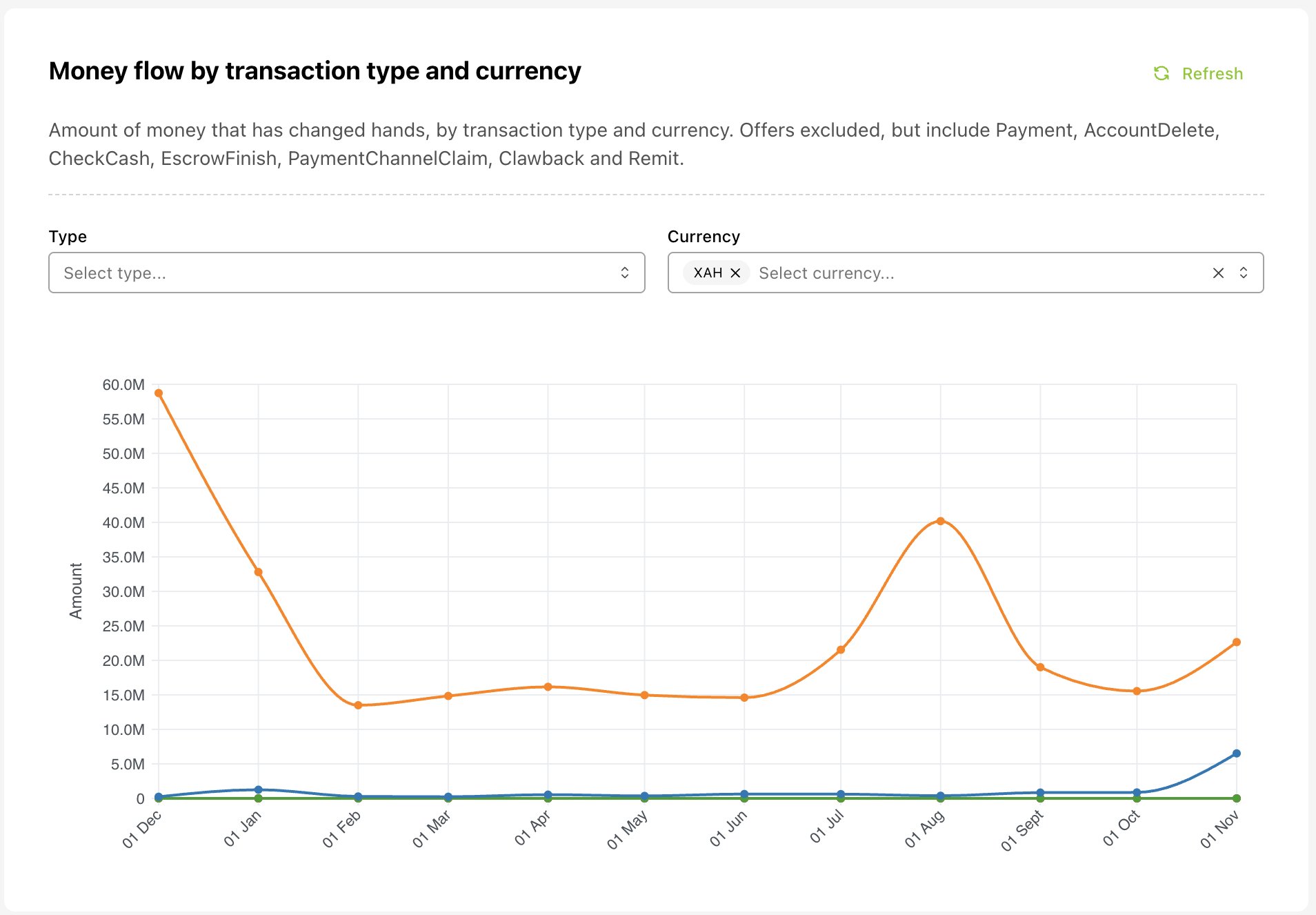

Xahau’s Decentralized Exchange (DEX)

Xahau's parent chain, the XRP Ledger, boasts a DEX that has grown up from its roots in 2012 to a high-volume marketplace in 2025.

In contrast, Xahau is at the beginning stages of its native DEX journey. DEX activity on Xahau shows a clear concentration around a few core trading pairs:

Xahau (XAH) Decentralized Exchange

Xahau (XAH) Decentralized Exchange

The most active pair by far is XAH/EVR, followed by XAH/MAG, XAH/XRP, XAH/CLV, and XAH/USD. This pairing distribution reinforces the close relationship between Xahau and Evernode-related assets, while also showing early but meaningful cross-ecosystem trading interest.

Popular Hooks

Hook execution statistics exemplify the Evernode project’s central role in on-chain activity.

The most executed hooks were:

- EVR Registry Hook (102.4M executions)

- EVR Heartbeat Hook (53.2M)

- EVR Reputation Hook (51.7M)

Together, these account for the vast majority of hook executions. Additional hooks include EVR Redirect (14.5M) and two versions of the EVR RW Forwarder, with 1.6M and 164K executions respectively.

The Xahau Governance Reward Hook saw just 52K executions, again highlighting that governance interactions remain a small slice of overall activity.

Other 'retail' hooks have been developed as well, and as the network moves forward with an increasing number of accounts, it may show that these smart contracts will rise in popularity.

Ringing In The New Year

Xahau’s second calendar year shows a network that is utilized and highly programmable.

Transaction volumes are substantial, hook execution is pervasive, and Evernode-related activity clearly anchors much of the ecosystem. While governance participation and escrow usage remain relatively low, the dominance of hooks and token-related transactions suggests that Xahau is being used, in addition to a payment rail, as a platform for automated, on-ledger logic.

As the network matures, these numbers establish a clear baseline for measuring where growth — and behavioral shifts — emerge next.

X>

Sources: